Did you know 40% of renters in the UK live in cold, damp homes? Landlords often ignore these issues. This shows the urgent need for better rental homes. The Build to Rent model is changing this.

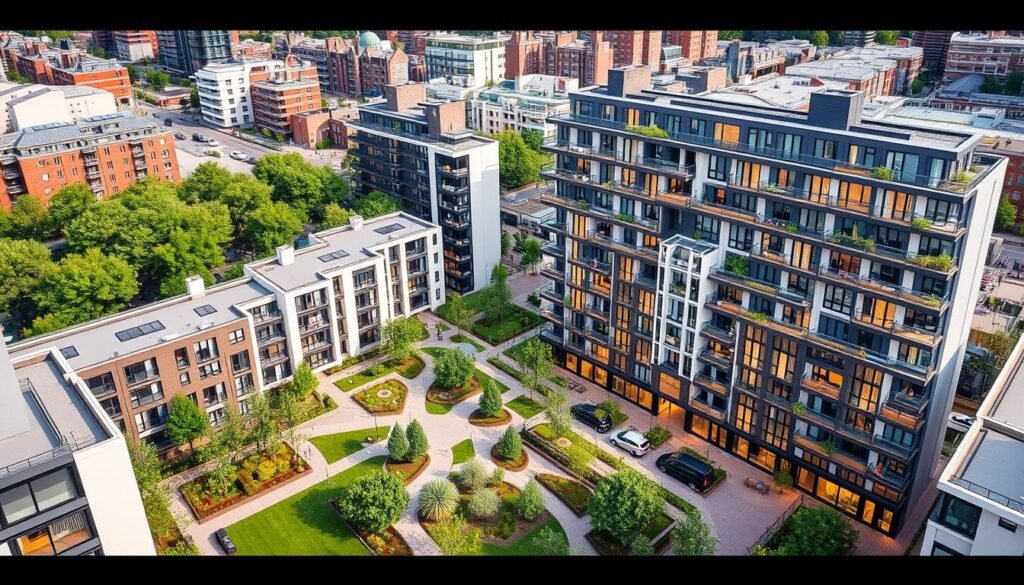

Build to Rent, or BTR, is transforming the UK’s rental market. These homes are built with tenants in mind, offering a new choice. Over 242,500 BTR homes are being built or planned across the UK.

Unlike regular rentals, BTR homes are well-managed and come with amenities. They are owned by one landlord, ensuring quality and service. This solves many problems in the current rental market.

The Build to Rent model is more than just homes. It’s about comfort, convenience, and community. With flexible leases and professional management, BTR is changing what renting means.

Key Takeaways

- Build to Rent offers high-quality, purpose-built rental homes

- BTR developments typically have at least 50 units under single management

- Over 242,500 BTR homes are in various stages of development in the UK

- BTR properties often command 8% higher rents than traditional rentals

- The model addresses common issues in the rental market, such as poor maintenance

- BTR offers flexible tenancy options, including longer-term leases

- London leads in completed BTR developments, but regional growth is increasing

Introduction to Build to Rent

Build to rent housing is a big trend in the UK property market. It’s changing how we live in cities, offering a new way to rent homes. This is different from the usual private rentals.

Definition and Origins of Build to Rent

Build to rent properties are made just for renting. They started in 2012. The idea is to give high-quality, well-managed homes for long-term tenants.

These homes are owned by big landlords. This means tenants get the same standard and service everywhere.

Key Players in the Build to Rent Sector

Big names in property are investing in build to rent. Companies like Legal & General, AXA, and Allianz see its potential. By Q2 2023, there were about 88,000 build to rent homes in the UK.

More than that were being built or had plans. This shows the sector is growing fast.

But, it only makes up about 1.6% of the UK’s private rentals. This means there’s a lot of room to grow, especially in cities. A Savills report says £2.5 billion was spent on build to rent in the first half of 2022. This shows the sector’s big potential.

Distinguishing Build to Rent from Traditional Rentals

Build to rent developments are changing the UK’s private rented sector. They provide a special living experience, different from traditional buy-to-let homes.

Key Differences

Build to rent properties are made for renters. They have top-notch amenities like gyms, coworking spaces, and lounges. You also get 24-hour concierge services and quick maintenance.

These developments offer longer rental agreements, often for three years. This gives renters more stability than traditional rentals. Many schemes also use ‘deposit alternative products’ instead of traditional deposits, making things easier for renters.

Build to rent properties focus on being eco-friendly. They must cut carbon dioxide emissions by 30% due to new rules. You’ll find features like solar panels and energy-saving systems, appealing to those who care about the environment.

| Feature | Build to Rent | Traditional Rentals |

|---|---|---|

| Amenities | Premium facilities (gyms, lounges, etc.) | Basic or limited |

| Management | Professional on-site teams | Often individual landlords |

| Lease Terms | Longer, more flexible | Typically shorter |

| Sustainability | Eco-friendly features standard | Varies widely |

Build to rent developments have many benefits, but they’re pricier. Still, for many, the extra quality of life is worth it. This makes them a growing choice in the UK’s rental market.

Growth of the Build to Rent Market

The build to rent market in the UK has grown a lot. It’s changed how we invest in homes. Now, more investors see it as a strong chance in the housing market.

Current Market Size and Trends

Recent data shows the build to rent sector’s size:

- Over 115,000 completed build to rent homes, a 24% jump from Q2 2023

- 45,400 homes under construction

- 100,700 homes in the planning stage

The market is growing fast. Build to rent homes in big cities are rented out 25% quicker now. It takes just 24 days on average.

Investment and Future Projections

The build to rent sector is getting a lot of investment:

| Period | Investment Amount | Single-Family Housing Share |

|---|---|---|

| Q2 2024 | £1.2 billion | 77% (£816 million) |

Experts think the market will keep growing:

- It could make up to 35% of all private rentals

- Single-family homes in build to rent could double in two years

These forecasts show more chances for investors and developers. They make the build to rent market a big part of the UK’s housing investment.

Advantages of Build to Rent for Tenants

Build to rent is becoming more popular in the UK. It offers a special living experience that traditional rentals can’t match. This is because purpose-built rental homes are designed with the tenant in mind.

Quality of Build and Amenities

Multi-family rental buildings focus on the tenant’s needs. They have modern designs and high-quality finishes. Many include:

- Concierge services

- On-site gyms

- Communal areas

- High-speed broadband

Flexible Tenancy Options

Purpose-built rental homes offer more flexibility. Tenants can choose lease lengths from 6 months to 3 years. This gives them security and helps them plan for the future.

Professional Management

Build to rent properties are managed by professionals. This means:

- Quick response to maintenance issues

- Transparent rental agreements

- Efficient property management systems

A YouGov study found 40% of people prefer renting from a responsible company. This shows the appeal of professionally managed build to rent properties.

| Feature | Build to Rent | Traditional Rental |

|---|---|---|

| Amenities | Extensive (gym, concierge, etc.) | Limited |

| Lease Length | Flexible (6 months to 3 years) | Typically 6-12 months |

| Management | Professional team | Often individual landlords |

| Pet-friendly | Often allowed | Varies |

build to rent, what is it

Build to rent, or the build-to-rent scheme, is a new trend in the UK housing market. These homes are made just for renting. They offer a special living experience for those who rent them.

Professional landlords and big investors own and look after these places. They focus on quality and making a community feel. This makes living there convenient and enjoyable.

The idea of build to rent started in the UK around 2012. It has become very popular since then. These homes are modern, save energy, and have the latest technology and finishes.

Build to rent homes come with lots of extras. Tenants get to use:

- Gyms and spas

- Communal workspaces

- Social event spaces

- Cinema rooms

- 24-hour concierge services

These schemes also offer more stability for renters. They often have longer tenancies, like three years. This is more secure than the usual short-term rentals.

| Feature | Build to Rent | Traditional Rentals |

|---|---|---|

| Ownership | Single landlord or management company | Various individual landlords |

| Tenancy Length | Often 3+ years | Typically 6-12 months |

| Amenities | Extensive on-site facilities | Limited or none |

| Management | Professional, on-site teams | Varies by landlord |

| Community Focus | Strong emphasis | Limited or none |

By early 2021, there were about 23,000 build to rent homes in the UK. Almost 100,000 more were planned. This shows how much people want this new way of housing.

Challenges and Criticisms of Build to Rent

The Build to Rent (BTR) sector in the UK has grown fast, with over 80,000 units ready, being built, or planned. But, this growth comes with its own set of problems. These include worries about rental housing prices and how it affects the market.

Affordability Concerns

One big issue is the cost for tenants. BTR homes often have higher rents, up to 15% more than other private rentals. This makes it hard for many middle-income families to afford these homes.

Impact on Local Rental Markets

The rise of BTR in local areas has sparked many debates. Some fear it could push up rental prices, leading to gentrification. The growth of ‘corporate landlords’ through big BTR projects is also a concern, changing how local rental markets work.

Despite these issues, BTR still attracts a lot of investment. Knight Frank says investors plan to put £50 billion into BTR by 2020. To tackle affordability, some projects offer ‘affordable private rent’ options, with prices at least 20% lower than market rates for some units.

As BTR grows, finding a balance between making money and meeting community needs and affordability is crucial. This is a challenge for developers and policymakers.

Investment Opportunities in Build to Rent

The build to rent sector is attracting many investors looking for steady income. It has grown fast, with £1.7 billion invested in the first half of 2022. This follows a record £4.3 billion in 2021.

Investment Vehicles and Strategies

Institutional investors have several ways to get into build to rent:

- Direct development of large-scale projects

- Partnerships with established developers

- Investment in specialised Real Estate Investment Trusts (REITs)

These methods help investors benefit from the sector’s growth. There are 82,500 completed homes and 49,500 under construction in the UK as of Q1 2023.

The build to rent market is changing quickly. Savills predicts 30,000 homes will be completed each year by 2026. This is 13.5% of the yearly supply. It’s a big chance for investors to grow their portfolios.

| Year | Completed Homes | Homes Under Construction | Homes in Planning |

|---|---|---|---|

| 2022 | 72,668 | 46,304 | 106,380 |

| 2023 (Q1) | 82,500 | 49,500 | N/A |

There are only 5,000 suburban build-to-rent homes in the UK. This means there’s a lot of potential in suburban areas. It’s a chance to meet the demand for quality rental homes outside cities.

Build to Rent and Affordable Housing

The build to rent scheme has grown a lot in the UK’s rental market. Over the last five years, it has become a clear sector, focusing on quality housing. Even though it’s not mainly for affordable housing, many schemes include cheaper options.

Rules say 20% of these schemes must offer affordable housing. These units cost 20% less than market prices. In London, the Draft London Plan wants 35% of these units to be affordable.

But, critics say these ‘affordable’ units might still be too expensive for many. The discount is based on possibly high market rates. This has led to debates about how affordable these schemes really are.

Local authorities are urged to create policies for build to rent. This helps ensure developments are both profitable and affordable. It’s important for policymakers and the industry to work together to find this balance.

As the build to rent market grows, with £1.7 billion invested in the first half of 2022, making housing affordable is a big challenge. Both developers and policymakers need to focus on this.

Build to Rent Developers and Locations

The build to rent UK market has grown a lot in recent years. Big names in the sector are changing the rental scene. They offer top-notch homes in the best spots.

Key Players in the Market

Big names like Greystar, Get Living, Essential Living, and Fizzy Living are leading the way. They focus on building communities, not just homes.

| Developer | Notable Projects | Key Features |

|---|---|---|

| Greystar | Greenford Quay, London | Riverside living, onsite gym |

| Get Living | East Village, London | Olympic Park location, no deposits |

| Essential Living | Vantage Point, London | Panoramic views, co-working spaces |

| Fizzy Living | Fizzy Lewisham, London | Pet-friendly, 24/7 maintenance |

Geographic Distribution

London is at the forefront with 104,205 units. But, other cities like Manchester, Birmingham, and Leeds are catching up. The UK now has 263,694 build to rent homes, with 92,140 already built and 59,043 in the making.

Build to rent isn’t just for city dwellers. It’s also popular for suburban family homes. This makes it appealing to a wide range of people.

Conclusion

The build to rent future is looking bright. This new trend is changing the UK housing market. It’s growing fast, especially in cities with housing shortages.

Build to rent is meeting key needs in the rental sector. It stands out because of its professional management and consistent service. This makes it different from traditional rentals.

Build to rent is becoming more popular with tenants and investors. The sector is growing, with new funds and traditional developers joining. This shows the UK housing market is changing, with more people choosing to rent long-term.

However, build to rent also faces challenges. There are worries about affordability and its impact on local communities. Yet, as it grows, it’s set to be a big part of the UK’s housing future. It could help solve the housing crisis and change the rental market.